UPI apps now allowing its users to make online/offline payments via their Rupay credit cards.

In Short

- From June 2022 RBI allowed to make UPI transaction via credit card.

- Credit card holders can link their banks accounts to UPI applications and make payments.

- Users can make credit card UPI transactions using the same process as other UPI transactions.

In recent years, the Unified Payments Interface (UPI) has revolutionized the way we make payments in India. UPI enables seamless and instant fund transfers between different bank accounts and eliminating the need for traditional methods like cash, cheques, or even net banking. UPI apps such as Google Pay, PhonePe, and Paytm have gained immense popularity over recent years with making transactions quick, secure, and more convenient. However, what happens when you want to make a transaction, but you don’t have enough balance in your bank account? This is where credit cards come in handy. Scan merchant’s QR-Code and make UPI payments through your credit card using UPI payment apps are now possible in India.

Which UPI Payment Apps Allow Credit Card Payments?

Several UPI payment apps now allow credit card payments. Here is a list of some popular UPI payment apps that allow Rupay credit card payments:

- Google Pay

- PhonePe

- Paytm

- BHIM

- Amazon

How to Link Your Credit Card to UPI Payment App?

To link your credit card to a UPI payment app, follow these simple steps:

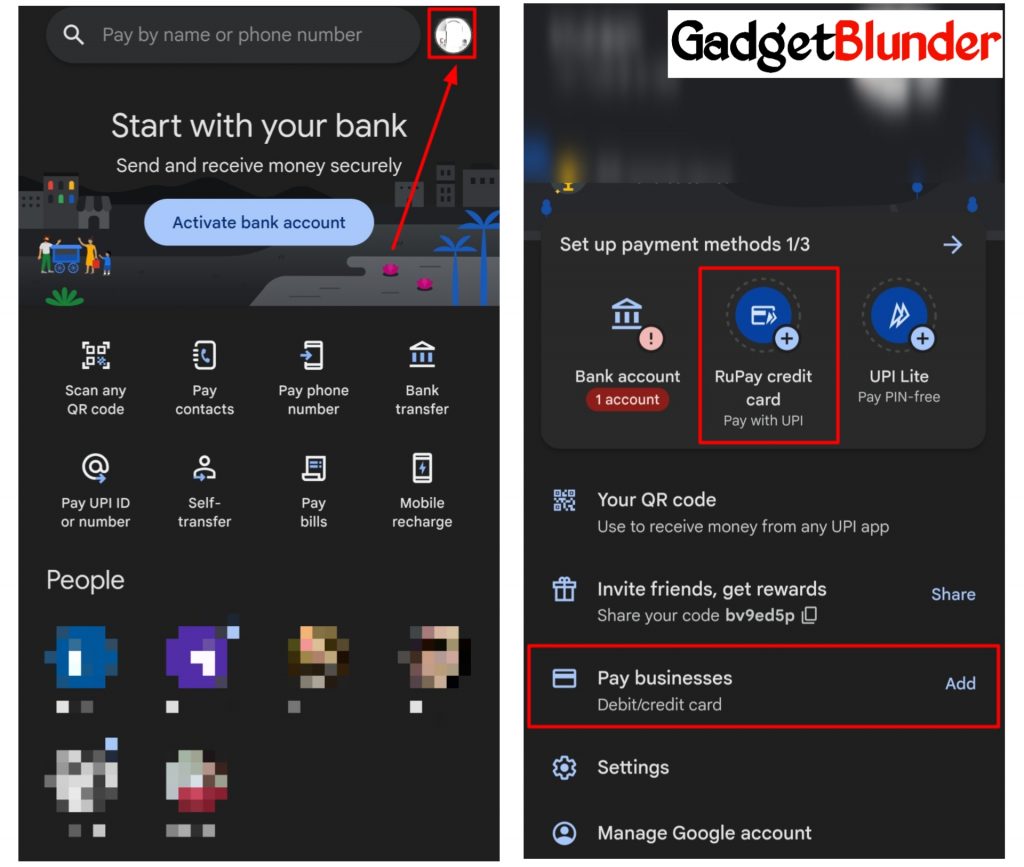

1. Link Credit Card to Google Pay

1. Open Google Pay application and click on profile icon.

2. Either tap Set up payment methods or tap Pay businesses and select Add credit or debit cards.

3. Tap Proceed to continue.

4. Now to add your card you can scan your card, or you can Enter details manually.

5. Add expiry date and CVV.

6. Now, tap Save.

7. To verify your card, enter the OTP (One-time-password) that you receive to the registered number.

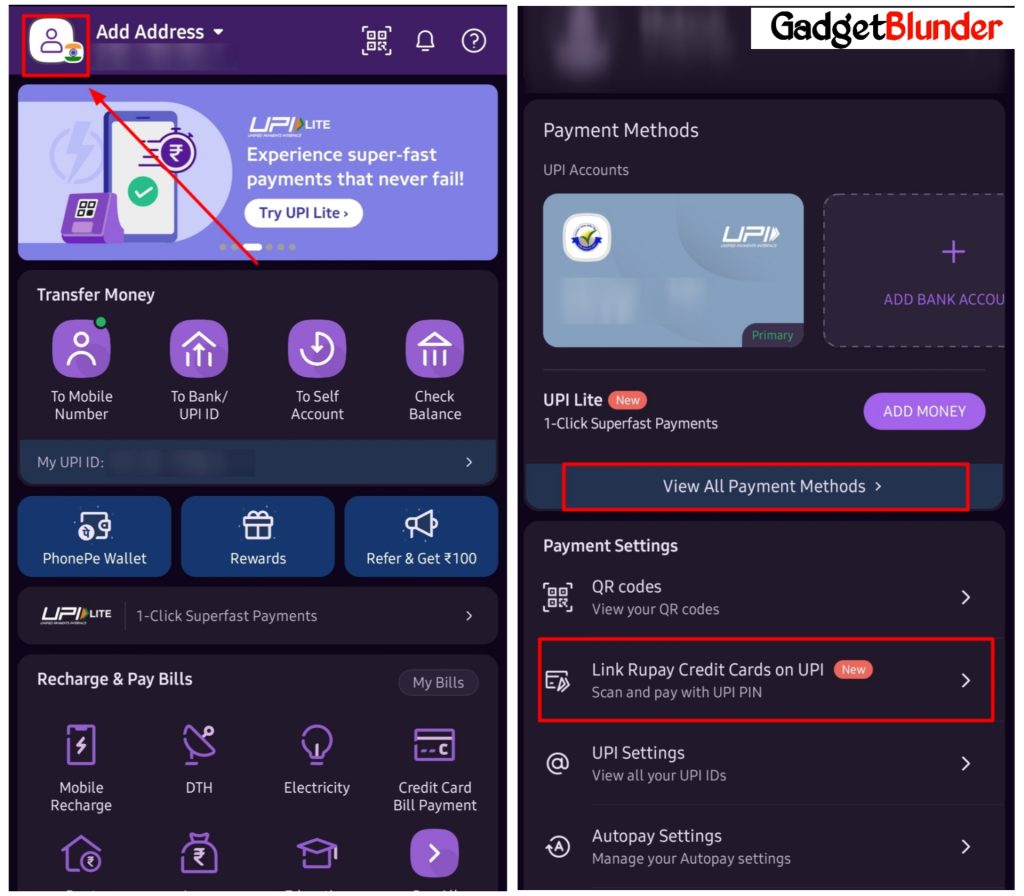

2. Link Credit Card to PhonePe

1. Open PhonePe app and tap your profile.

2. Either tap Link Rupay Credit Cards on UPI or tap View All Payment Methods under Payment Methods.

3. Tap on ADD CARD.

4. Enter card details manually and tap ADD.

5. On the next page, enter the 6-digit OTP, and tap Submit.

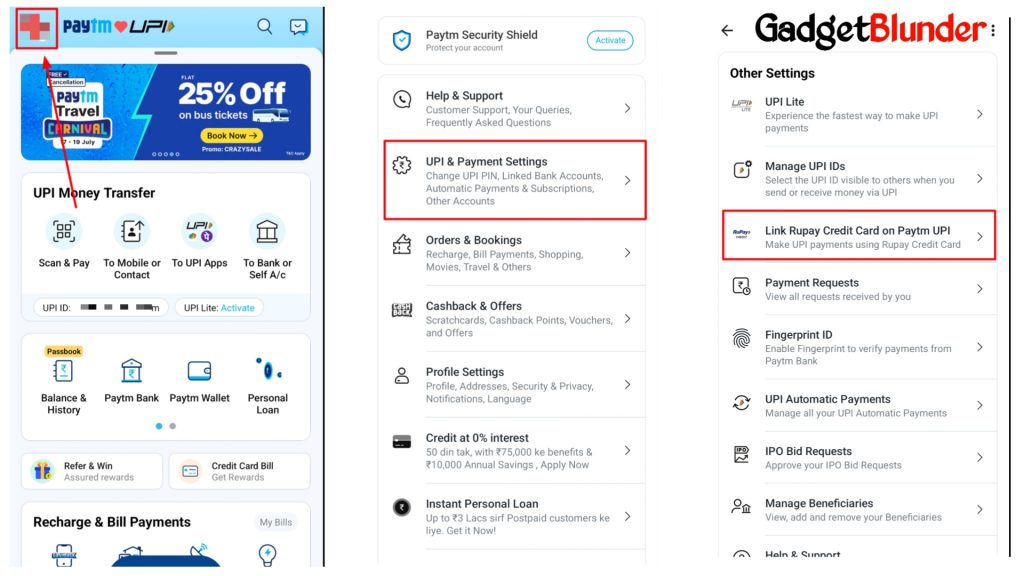

3. Link Credit Card to Paytm

1. Open Paytm app and click on profile icon.

2. Scroll down and tap UPI & Payment Settings.

3. Now again scroll down and tap on Link Rupay Credit Card on Paytm UPI.

4. Add your credit card details and tap Proceed.

5. Verify your credit card details using the one-time password (OTP).

How to Make UPI Payments through your Credit Card?

Now your credit card is successfully linked to the UPI payment app, follow these simple steps to make a UPI payment using your credit card:

1. Making UPI Payments Through Credit Card Using Google Pay

- Open Google pay and choose any option where you want to make payment.

- Enter the details where you want to pay (for example- enter mobile no. for mobile recharge, bill no. for bill payment etc.).

- Enter the Amount and select the payment method as Credit card.

- Enter your credit card details and the OTP.

- Verify the payment details and click on Proceed.

2. Making UPI Payments Through Credit Card Using PhonePe

1. Open PhonePe and choose any option where you want to make payment.

2. Enter the details where you want to pay (for example- enter mobile no. for mobile recharge, bill no. for bill payment etc.).

3. Enter the Amount and select Credit card as payment method.

4. Enter your credit card details and the OTP.

5. Verify the payment details and click on Proceed.

3. Making UPI Payments Through Credit Card Using Paytm

1. Open Paytm and choose any option where you want to make payment.

2. Enter the details where you want to pay (for example- enter mobile no. for mobile recharge, bill no. for bill payment etc.).

3. Enter the Amount and select Credit card as payment method.

4. Enter your Credit card details and the OTP.

5. Verify the payment details and click on Proceed.

What Are the Charges for Making UPI Payments Using Credit Card?

While UPI payments using credit cards are convenient, they may come with additional charges. The charges levied on UPI payments using credit cards vary between UPI payment apps and credit card issuers. Till now, As per RBI guidelines there will be no charges for Rupay credit card on UPI transaction of up 2000 Rs.

Benefits of Making UPI Payments Using Credit Card

Despite might have some additional charges, making UPI payments using credit cards comes with a few benefits. Here are the benefits of using your credit card for UPI payments:

1. Earn Reward Points and Cashbacks

Most credit cards offer reward points and cashbacks for every transaction. Making UPI payments using your credit card can help you earn points and cashbacks, which can be redeemed later.

2. Better Security and Fraud Protection

Credit cards offer better security and fraud protection than debit cards. In case of fraudulent activities or unauthorized transactions, the credit card company can issue a chargeback.

3. Easy Access to Credit

UPI payments using credit cards can help you access credit quickly and conveniently. You don’t have to worry about having enough balance in your account or applying for a loan.

Precautions to Take While Making UPI Payments Using Credit Card

While UPI payments using credit cards offer convenience, it is essential to take necessary precautions to avoid fraudulent activities and protect your credit card information. Here are a few precautions to take:

Measures to Avoid Fraudulent Activities and Protect Your Credit Card Information

- Do not share your credit card details like 16-digits card number, expiry date or even CVV with anyone.

- Use only trusted UPI payment apps.

- Check the payment details before proceeding with the transaction.

- Never click on any suspicious links or emails.

Best Practices for Making online Secure Payments

- Keep your UPI Payment application secure and password protected.

- Opt for two-factor authentication and biometric authentication.

- Keep your UPI payment app and phone updated.

Conclusion

UPI payments using credit cards can provide a convenient and efficient way of making online transactions. UPI payment apps like Google Pay, PhonePe, Paytm, Amazon and more have integrated this feature to provide more convenience to their users. However, remember to always exercise caution while making online payments and protect your personal and financial information.

Frequently Asked Questions (FAQ)-

Q.1- Can I link multiple credit cards to a single UPI app?

Yes, most UPI apps allow you to add and link multiple credit cards to your account.

Q.2- Is it safe to make UPI payments using a credit card?

Yes, UPI transactions through credit cards are generally secure. However, it’s essential to follow standard security practices like protecting your card details and UPI PIN.

Q.3- Can I use my virtual credit card for UPI payments?

Yes, you can use your virtual credit card to make UPI payments.

Q.4- Are there any transaction limits for credit card UPI payments?

Transaction limits may vary depending on the UPI app and your bank. It is advisable to check with your bank or UPI app for specific limits.

Q.5- Can I earn rewards or cashback by using a credit card for UPI payments?

Some credit cards offer rewards or cashback on UPI transactions. Check with your credit card issuer for any such benefits.

Q.6- Can I use my credit card for UPI payments internationally?

UPI payments are primarily designed for domestic transactions within India.